Français

Français

Daily news reports over the past two years have frequently reported that historically, high inflation has put a lot of strain on Canadians due to disruptions in the global supply chain and labour shortages as a result of the pandemic. Compared to 2021, the average CPI in Canada grew by 6.8% for all products. All three of the primary beef proteins experienced CPI growth rates that were higher than those of all other goods. Compared to 2021, Canadians had to pay 7.7% more for the same amount of chicken, while the corresponding figures for beef and pork were 8.5% and 3.5%, respectively.

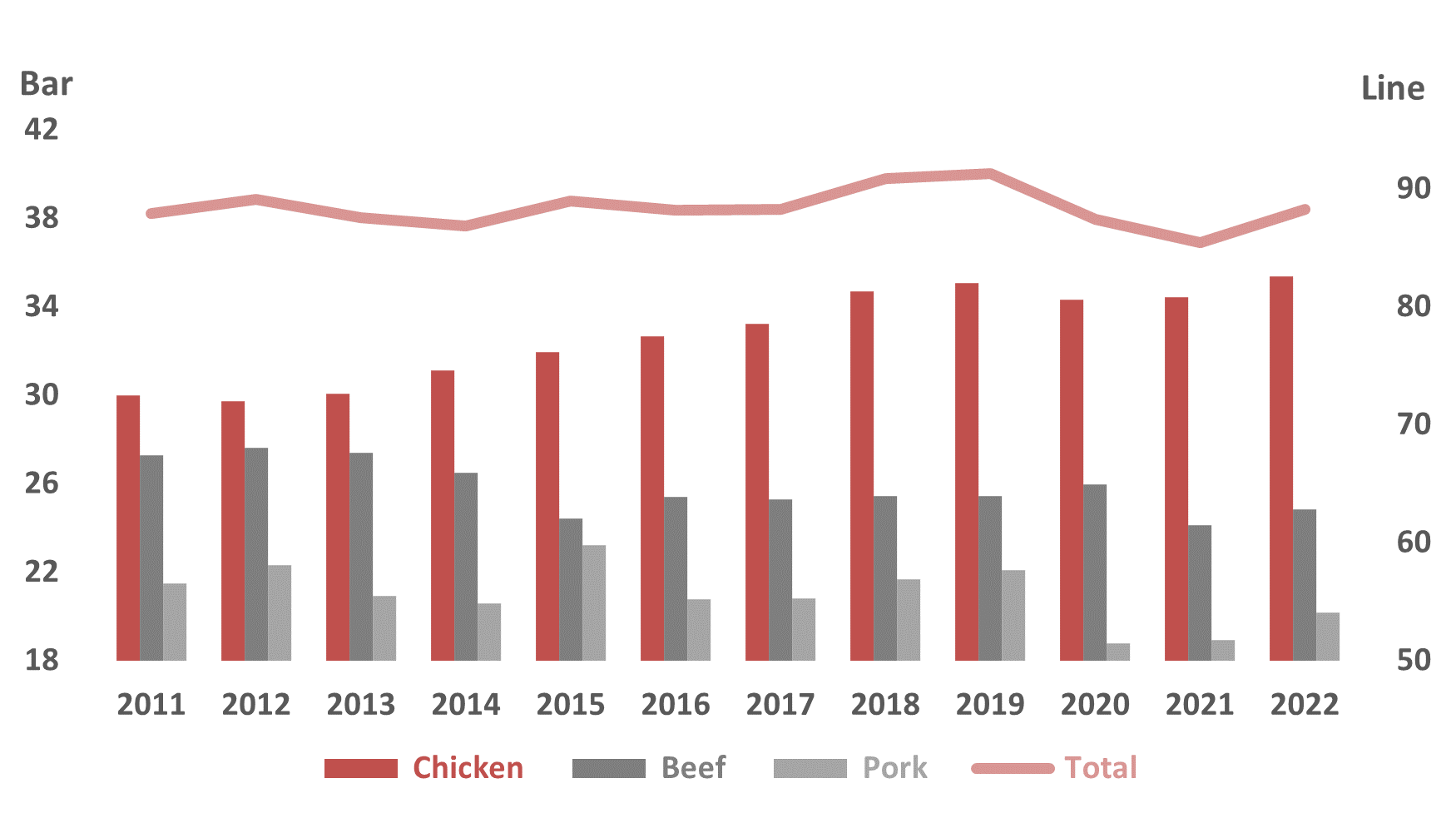

Statistics Canada data reveals that each Canadian consumed 2.8 kg (3.3%) more meat in 2022 compared to the previous year, despite significant inflation and seven interest rate increases by the Bank of Canada. In 2022, the first year with positive growth since the epidemic in 2020, each Canadian bought 88.3 kgs of different meat on average. Due to its affordable price compared to beef and chicken, as well as its slower or even negative inflation rate for specific cuts, pork took the No. 1 spot by gaining 1.2 more kg per person. Chicken was the second-largest contributor to this rise in consumption, accounting for 0.9 kg more, and was one of only two meat protein types to reach pre-pandemic levels (the other meat types were mutton and lamb). Despite being relatively pricey, there was a 0.7 kilogram increase in per-capita beef consumption in 2022. See Chart 1 for more details.

Chart 1 Per Capita Meat Consumption in Canada (2011 onwards)

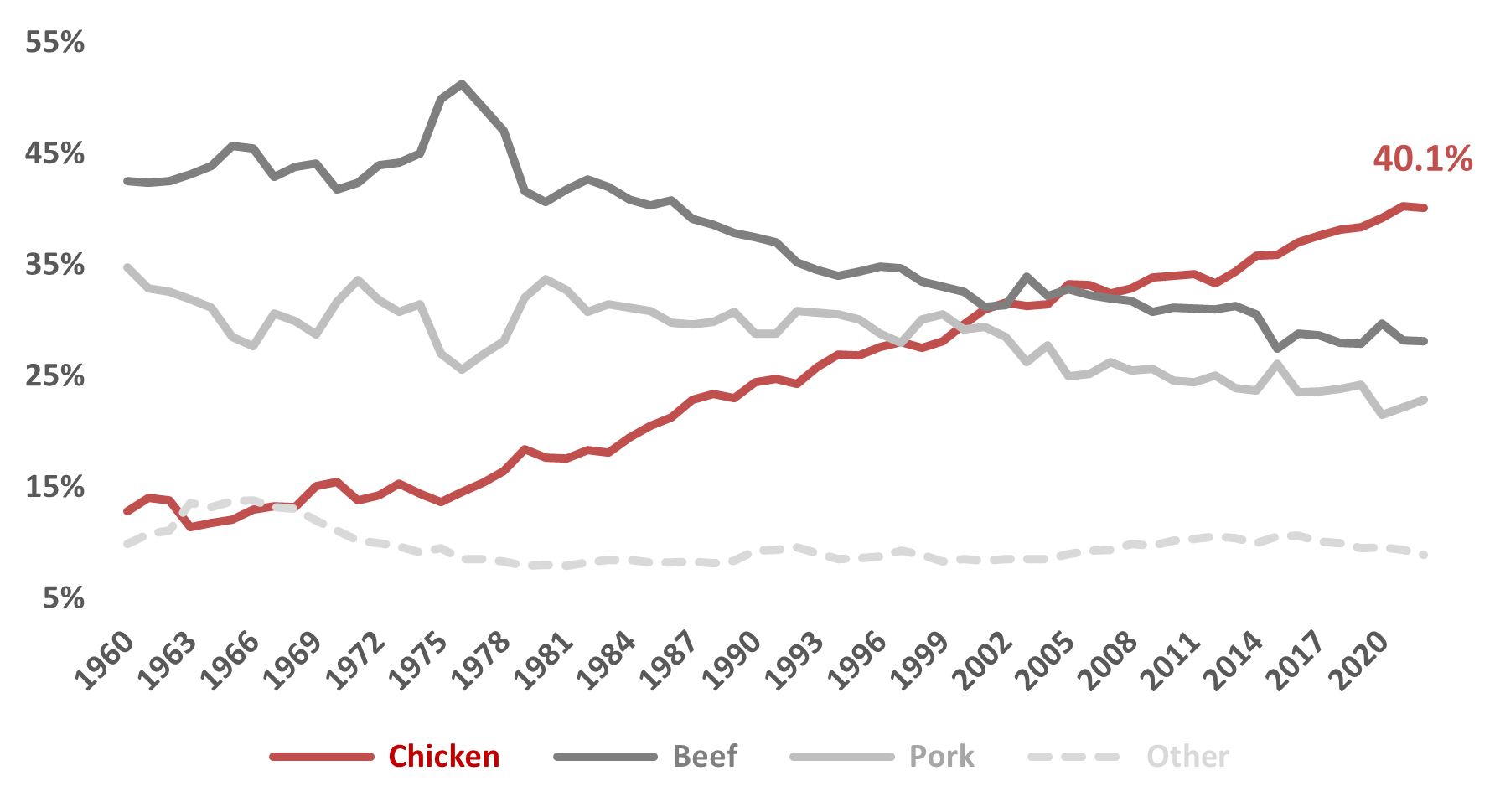

The other positive news for chicken is that it continues to rank high among all the proteins, which is not surprising. Since the 1960s, Canadians have consistently consumed less than 10% of other meats such lamb, veal, fowl, and turkey. As a result, the primary meat protein sectors saw intense competition. The share gap between beef and chicken increased from 2.4 percentage points (33.4% vs. 31.0%) to 12.0 percentage points (40.1% vs. 28.1%) in the last ten years. Since 2021, chicken has made up more than 40% of per Canadian’s sources of meat protein, reaching an all-time high of 40.3%. This percentage decreased slightly to 40.1% in 2022 as a result of increased pork consumption. The evolution of the meat protein share since the 1960s is seen in Chart 2.

Chart 2 Meat Protein Share in Canada (available from 1960)

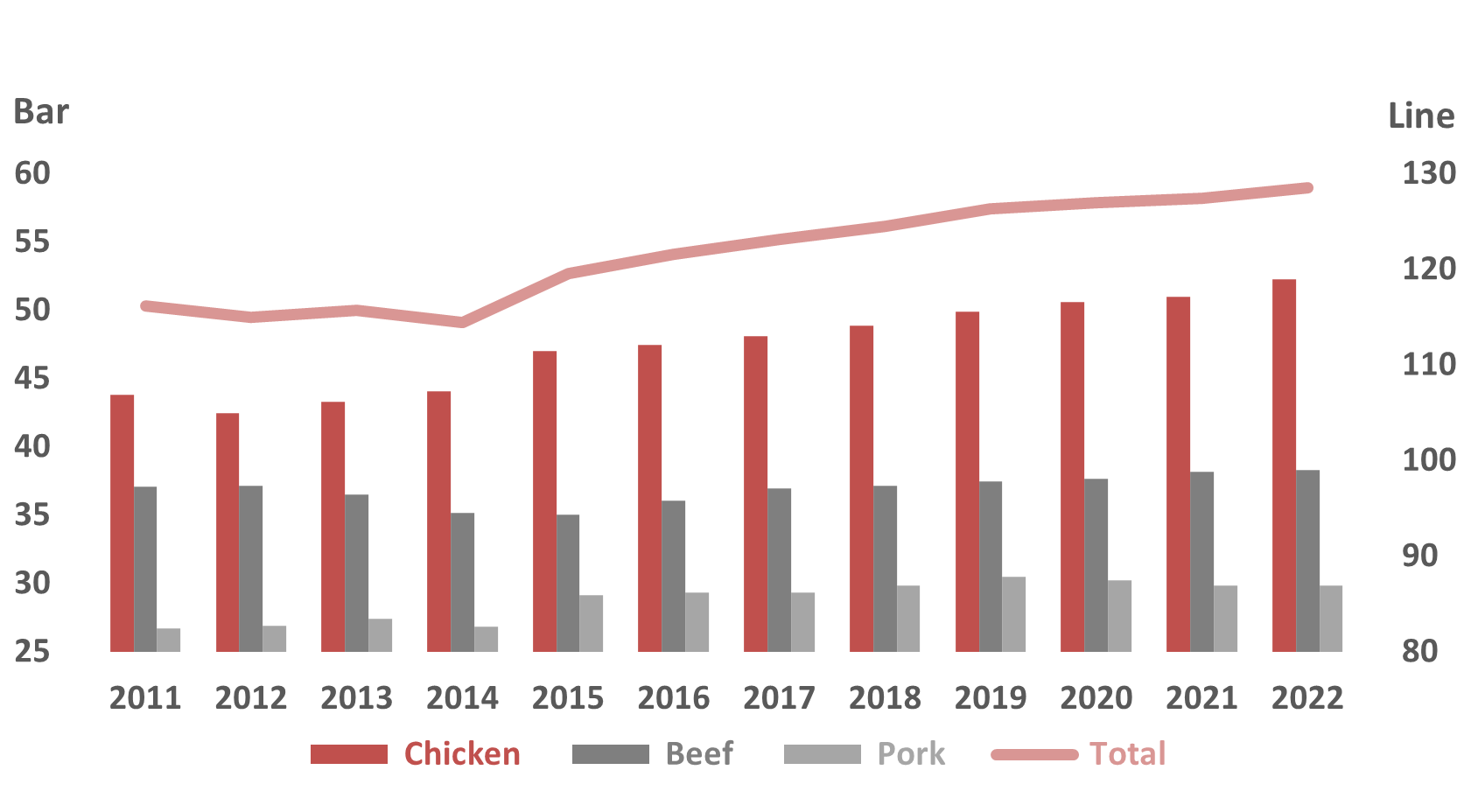

In 2022, Americans consumed 128.5 kg of meat, 1.1 kg (0.9%) more than they did in 2021. In contrast to Canadians, whose consumption patterns were more sensitive to price and inflation, Americans consumed 1.27 kg (2.5%) more chicken per person in 2022 than they did in 2021, although the CPI for chicken was 14.8% on average, due to a shortage of chicks and a higher hen mortality rate in early 2022, which is much greater than the average CPI for meat (8.2%). Consumption of beef and pig also saw a marginal rises, due in part to the tendency that Americans have become less fond of red meat due to health concerns. Both in Canada and the United States, turkey consumption has dramatically decreased. Chart 3 summarizes U.S. consumption of meat per-capita since 2011.

Chart 3 Per Capita Meat Consumption in US (2011 onwards)

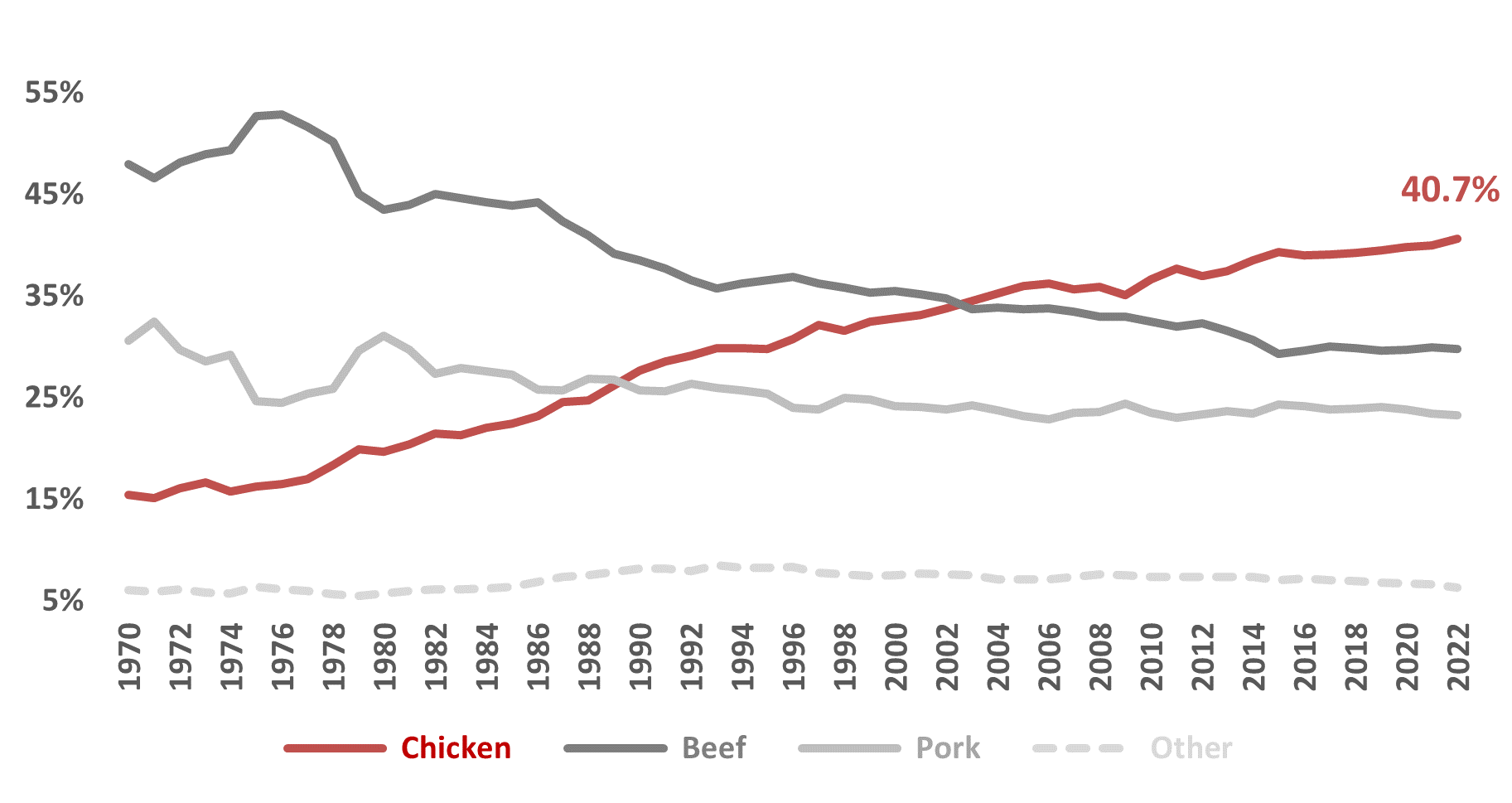

When comparing meat shares, both North American nations showed a similar pattern, however, the U.S. had a smaller proportion of other meat categories than Canada. Additionally, chicken surpassed the 40% mark in 2021, and its market share continued to rise in 2022 to reach 40.7%. See Chart 4 for the evolution since 1970s.

Chart 4 Meat Protein Share in U.S. (available from 1970)

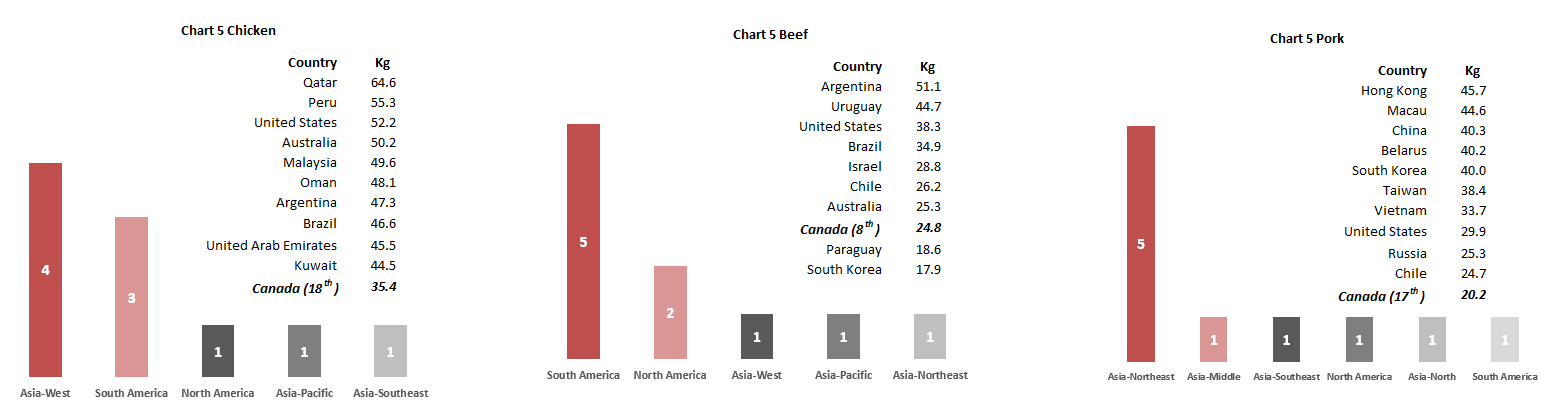

We examined the global per capita meat consumption of each primary meat protein. Canada’s chicken consumption was ranked 21 in the globe, down one spot from 2021, according to a calculation made using USDA statistics on domestic disappearance and United Nations population projections. Consumers consumed an average of 50.4 kg of chicken in the top 10 chicken-consuming nations in 2022. Three countries in South America, including Brazil and Argentina, were among the Top 10 largest producers of chicken, followed by six countries being in Asia, particularly West Asia, which has a predominantly Muslim population. In terms of beef per-capita consumption, Canada ranked eighth in the world in 2022, up three spots from the previous year. The average amount of beef consumed per person in the top 10 beef-consuming nations was 31.2 kg. Once more, South American nations accounted for more than half of the locations where renowned pastures are found. Northeast Asian countries and regions dominated 5 of the Top 10 countries with the largest consumption of pork as a result of food habits. In 2022, Canada had the 17th-best global ranking.

The charts below show the Top 10 countries for each main meat protein and regional breakdown.

Chart 5 Top 10 Countries with Highest Meat Per Capita Consumption in 2022

In conclusion, Canadians continued to favour chicken on their plates. The market’s demand for beef was beginning to equal pre-pandemic levels. When compared to competing meat, chicken consistently made up er meats, 40% of meat choices for consumers in North America, and also played a major role internationally.